Dear Studio Fam,

We are back to our usual overview of all things tech this week, including some unprecedented news hot off the presses: Silicon Valley Bank has failed. We also review competing Federal regulations of social media platforms, take a peek at the newest iPhone colorway, and spotlight major changes to one of the most popular streaming music apps. Finally you’ll see some insights into why your LinkedIn feed is not the same as it used to be.

Silicon Valley Bank Fails, FDIC Takes Over

In a stunning turn of events unseen since the 2008 financial crisis, Silicon Valley Bank was closed today by Federal regulators. In its place, the FDIC created the Deposit Insurance National Bank of Santa Clara to continue operations. SVB, a storied institution that got its start when Silicon Valley was known more for producing microchips than software, faced a run on deposits after reporting deep losses on its bond holdings. Similar losses on bonds were felt throughout the banking industry, the result of interest rates hikes by the Federal Reserve.

Faced with unprecedented deposits throughout 2020 and 2021 from pandemic spending programs, banks invested heavily in low yield bonds. While these bonds are not in default, their face values have eroded in the presence of higher and higher interest rates from the Federal Reserve. If an investor can buy a guaranteed bond from the Fed that pays 5%, the demand for bonds paying 1.5% is nonexistent and their price falls. After SVB was forced to mark down the value of its bond holdings, news that the bank was also trying to raise fresh capital triggered the run. Apparently unable to maintain its legally required leverage ratios in the face of massive customer withdrawals, regulators closed the bank.

Countless startups have come to rely on SVB as a banking partner due to its founding expertise in managing the capital and financial operational needs of venture backed companies. While the functional and operational support of SVB is almost definitely at an end, customers can almost certainly expect full restitution of their funds. On the other hand, SVB stockholders will not be so lucky.

Competing Social Media Laws Put TikTok In Cross Hairs

Among the major social media platforms in the United States, TikTok stands out for a number of reasons. First among them is its incessant popularity, especially among young Americans, which is caused in no small part by arguably the most compelling app user experience of all time. But perhaps most importantly, TikTok is owned by the Chinese company ByteDance, which has deep ties to the government of China. In 2020, President Trump announced he was considering banning TikTok on national security grounds and since then multiple Federal and State governments have banned its use on government smartphones.

There are currently two major pieces of legislation that seek to regulate, ban, or otherwise force the divestiture of TikTok to an American owner: the RESTRICT Act and the DATA Act (we’ll spare you the meaningless specifics of these acronyms). The biggest difference between the two is that the DATA Act would specifically target TikTok while the RESTRICT Act would empower the Secretary of Commerce to ban any foreign-owned social media platform at their discretion.

National security concerns notwithstanding, it seems reasonable to demand ByteDance divest TikTok to a US buyer simply because the Chinese government does not allow TikTok’s US competitors to operate in China. Cooperation is always better than conflict, so perhaps President Biden’s support of the RESTRICT Act could lead to a compromise whereby ByteDance remains in control of TikTok but the Chinese government allows its citizens to sign up for American social media services.

Studio Byte Of The Week

Apple loves to update its iPhone line with a spring colorway. This year, we got yellow! It’s the new green!

LinkedIn Comments Are Clogging Our Feeds

LinkedIn has never been a more valuable resource for job seekers and everyone is looking for an edge. That’s why you might have noticed that your LinkedIn feed is filled with a lot of comments from people outside your network. A new trend on LinkedIn has been identified called “commenting for reach” and it’s based on the idea that writing “Congrats!” on your friend’s new job announcement will promote yourself as much as it will compliment your friend.

The actual algorithm that decides whose posts and comments appear where remains secret and is constantly changing, much like the rest of LinkedIn’s features. LinkedIn also encourages the behavior, prefilling messaging boxes with trite messages and pre-selected emojis. Presumably LinkedIn product managers are following data that shows these features drive profits as LinkedIn increased its revenue by 26% in 2022, its biggest jump since before the pandemic.

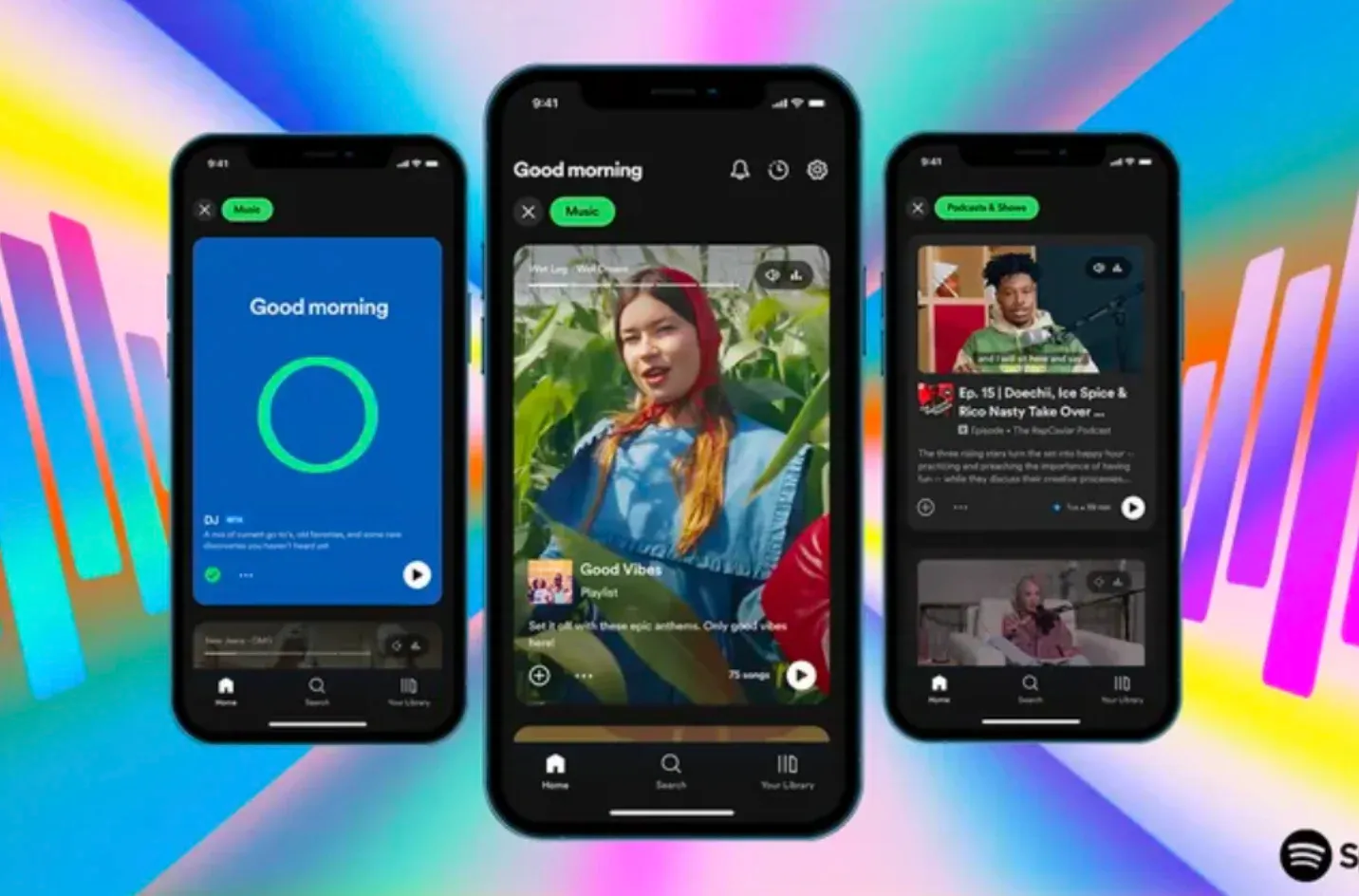

Short Bytes: Spotify Redesign

Spotify announced a major overhaul of its fundamental user experience this week, redesigning its home screen with cues from TikTok, Instagram, and YouTube. Here’s a rundown of the “Stream On” update:

- The Music and Podcast tabs now feature an endless vertical feed of snippets of music videos and podcasts clips.

- The new Smart Shuffle uses AI to personalize your existing playlists with suggestions of new music that compliments what you already love.

- The feed is optimized for discovery, not engagement, “to help users save time, not steal their time.”

We’re skeptical that Spotify doesn’t want users to spend more time in their app but excited to see how the new UX affects our personal content experiences.

Meta Quest Pro Price Cut

Things aren’t looking so good in the metaverse. This week Meta announced massive price cuts across its entire line of AR/VR products with hopes of growing its user base of legless avatars. Despite being on the market less than six months, the Meta Quest Pro has not been close to the success hoped by Mark Zuckerberg who recently reorganized the team building the next generation of its AR/VR operating system. Despite the price cut, the Meta Quest Pro is still $1000 – double the cost of the newest Playstation and Xbox gaming consoles. While the older Quest 2 has also been discounted down to $430, it remains a niche device with a small selection of games. This is probably why the word “metaverse” was said 95% fewer times on the February 2023 Meta earnings call compared to the same call six months prior.