Dear Studio Fam,

This week we spotlight product developments from Apple which up the stakes in their competition with Google, highlight one more new product from CES, and review new tech layoffs amidst the Great Tech Reset. But there’s plenty of positive economic news on the horizon, including impending monetization of the biggest player in generative AI. Finally, we take a look at a massive private startup’s valuation struggles and learn a little more about how companies with stock options must comply with regulation.

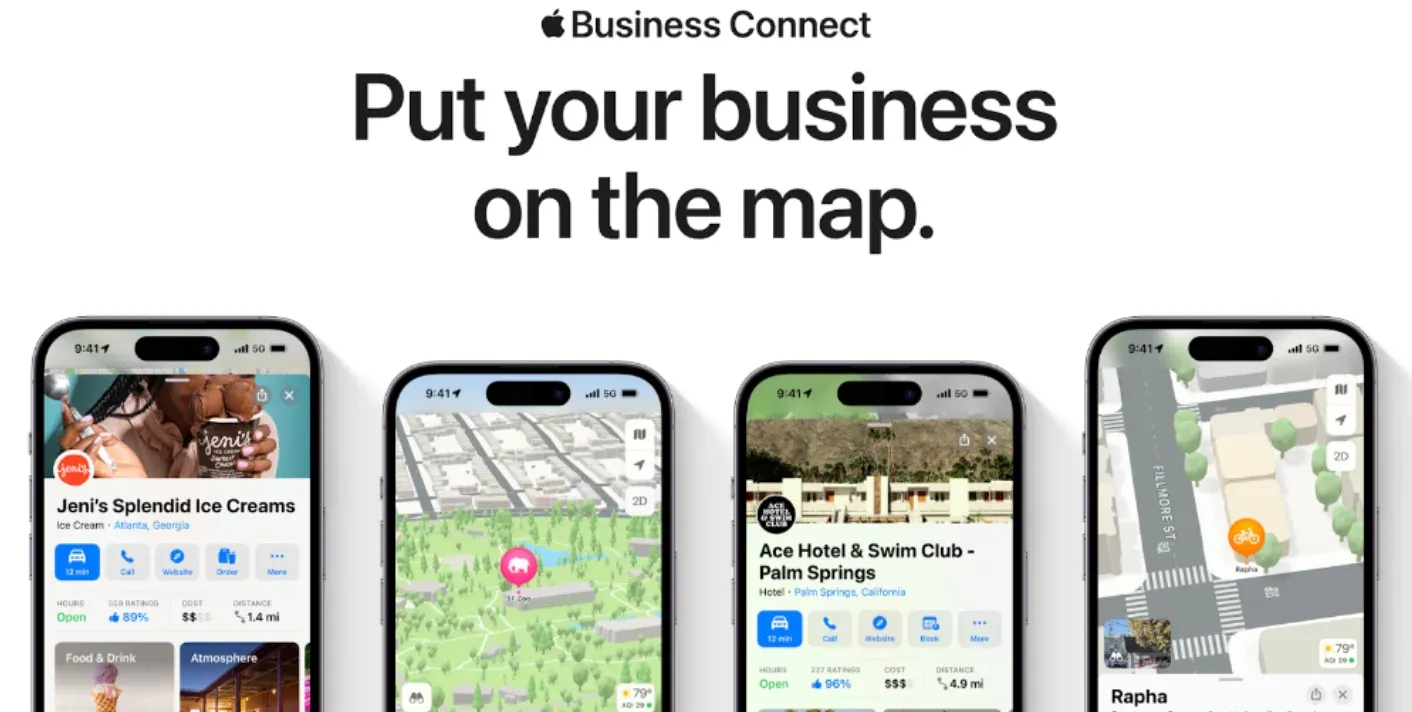

Apple Launches Business Connect To Power Revamped Apple Maps

In the early days of iOS, Google had a deal with Apple to feature Google Maps as the default map on every iPhone. While Google still pays Apple billions of dollars in “distribution” fees for its search to be the iOS default, Apple has long defaulted the iOS map experience to its own Apple Maps product. Unfortunately for many users, Apple Maps was inferior to Google Maps in data quality and sometimes even with the speed at which its navigation system could react while driving. But today’s Apple Maps is now on par with Google Maps, or even superior according to some users.

Now Apple Maps is about to become a lot more relevant with the launch of Apple Business Connect, “a free tool that allows businesses of all sizes to claim their location place cards and customize the way key information appears to more than a billion Apple users across Apple Maps, Messages, Wallet, Siri, and other apps,” according to Apple. While the fundamental user experience of Apple Maps has significantly improved, it was not possible until now for local businesses to easily customize their contact information, store hours, and other pertinent business information as displayed inside of Apple Maps.

Studio Byte Of The Week

The Consumer Electronics Show has ended, and one of the more compelling (but probably useless) demos came from Howie Mandel for the Proto Hologram Box.

ChatGPT Professional Coming Soon

The honeymoon phase of ChatGPT is likely coming to an end soon: get ready to start paying for continued access to the generative AI copy system, according to tweets by OpenAI President Greg Brockman. Users interested in getting early access to the “professional” version of ChatGPT can fill out this form. Ironically, the company is using a Google Form to collect early customer information despite Microsoft’s multi-billion dollar investment.

The ChatGPT team is under a lot of pressure to monetize what is known to be an extremely expensive service to operate. Each ChatGPT query allegedly costs upwards of 3 cents due to the language model’s extensive utilization of expensive cloud infrastructure. Most of the questions on the form relate to pricing sensitivity, indicating that the ChatGPT team is still trying to figure out how to properly price their system. With entry-level access to similar systems like Jasper.ai starting at around $100 per month, the ChatGPT team will probably have no problem finding many willing buyers of its superior service.

SHORT BYTES

More tech companies have announced layoffs, despite evidence the US will avoid a recession:

- Salesforce confirms parting with 10% of its staff

- Coinbase has cut 18% of its remaining staff after significant cuts last summer.

- Parler, the conservative social media site, let go 75% of its staff after an acquisition by Kanye West fell through.

- Verily, Google’s health sciences division, cuts 15% of staff

- Anywhere iBuyers has let go at least 11% of its workforce since June 11

- Carta lays off 10% of staff, 18 months after its last staff cuts

What’s a 409A? Stripe Cuts Internal Valuation

If you’ve ever run a company with a stock options program, you’ll be familiar with the 409A valuation process set by the IRS. If your stock ends up being worth something, you will calculate your tax bill based on the value assigned during the 409A process. This process is particularly important for startups with large valuations like Stripe, which has seen its capitalization in the tens of billions of several years.

Unfortunately for some Stripe stockholders, their latest 409A process led to another reduction in value. The 409A process must be run by a neutral third party who uses public market comparables to determine a fair market value for the target company. That means that even private companies like Stripe – who have not yet debuted their stock to retail investors – are subject to the swings of the public stock market. Big public fintechs like Shopify, Block, and Paypal have all seen significant hits to their stock prices. And that means Stripe investors must take a similar write down. But don’t worry too much: Stripe is still worth $63 billion.